The ROI calculator formula is a fundamental component of calculating Return on Investment (ROI) accurately. It is essential to understand the formula to leverage the full potential of an ROI calculator and obtain precise insights. This section will explain the ROI calculator formula and break down its components.

The ROI formula is relatively straightforward and can be expressed as follows:

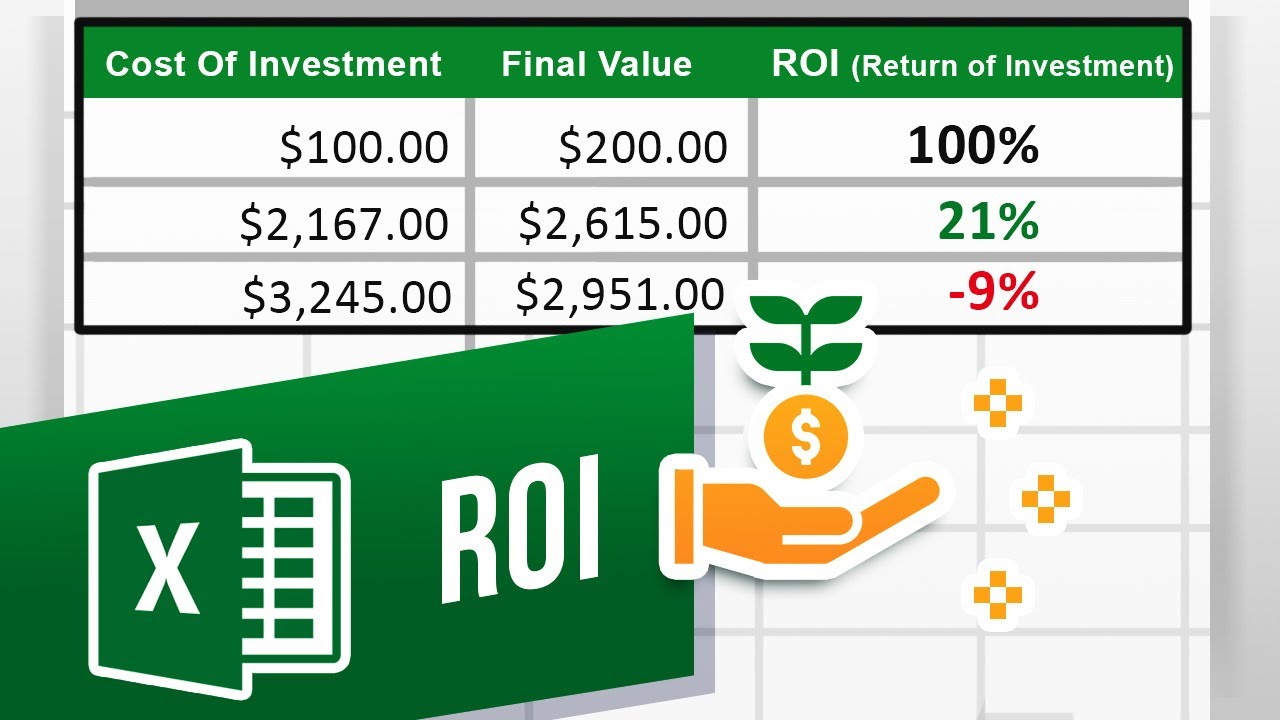

ROI = (Net Profit / Cost of Investment) x 100

To calculate ROI, you need two key pieces of information: the net profit generated by the investment and the cost of the investment itself. The net profit is the total returns or gains generated by the investment, minus any associated costs or expenses. The cost of investment refers to the initial amount of money invested in the project.

The ROI formula calculates the return on investment as a percentage, providing a standardized measure of profitability. By multiplying the result by 100, the ROI is expressed as a percentage, making it easier to compare different investments or assess their financial viability.

For example, if a company invests $10,000 in a marketing campaign and generates a net profit of $15,000, the ROI can be calculated as follows:

ROI = ($15,000 / $10,000) x 100 = 150%

In this scenario, the ROI is 150%, indicating that the marketing campaign generated a return that is 1.5 times the initial investment.

By understanding and utilizing the ROI calculator formula, businesses can accurately assess the profitability of their investments, make data-driven decisions, and optimize their returns.

It can be interesting for you – https://reply.io/email-template-categories/recruiting/.

Benefits of using an ROI calculator

Utilizing an ROI calculator offers numerous benefits to businesses of all sizes and industries. This section will explore the advantages of using an ROI calculator to assess the potential profitability of investments and inform decision-making processes.

One of the primary benefits of using an ROI calculator is that it provides accurate and quantifiable insights into the potential returns of an investment. By inputting the relevant data, businesses can obtain a clear measure of the financial impact of their investments. This information allows decision-makers to evaluate the risk-reward ratio and make informed choices based on solid financial projections.

Furthermore, an ROI calculator enables businesses to assess multiple investment scenarios and compare their potential returns. By adjusting variables such as costs, revenues, or time frames, companies can explore different possibilities and identify the most lucrative opportunities. This comparative analysis empowers decision-makers to select investments that offer the highest ROI and align with their strategic objectives.

Another advantage of using an ROI calculator is its ability to help businesses justify investments to stakeholders. By presenting the potential returns in a clear and concise manner, decision-makers can effectively communicate the financial benefits of an investment to investors, clients, or board members. This transparency enhances credibility and increases the likelihood of obtaining necessary funding or support.

Be the first to access Reply’s new database for free – https://reply.io/data/.